All Categories

Featured

Just pick any type of kind of level-premium, irreversible life insurance coverage policy from Bankers Life, and we'll transform your plan without requiring evidence of insurability. Policies are convertible to age 70 or for 5 years, whichever comes later - graded death benefit term life insurance. Bankers Life supplies a conversion credit(term conversion allocation )to insurance holders approximately age 60 and via the 61st month that the ReliaTerm plan has been in pressure

At Bankers Life, that indicates taking an individualized approach to assist shield the people and families we serve - level term life insurance meaning. Our goal is to offer superb solution to every insurance policy holder and make your life easier when it comes to your insurance claims.

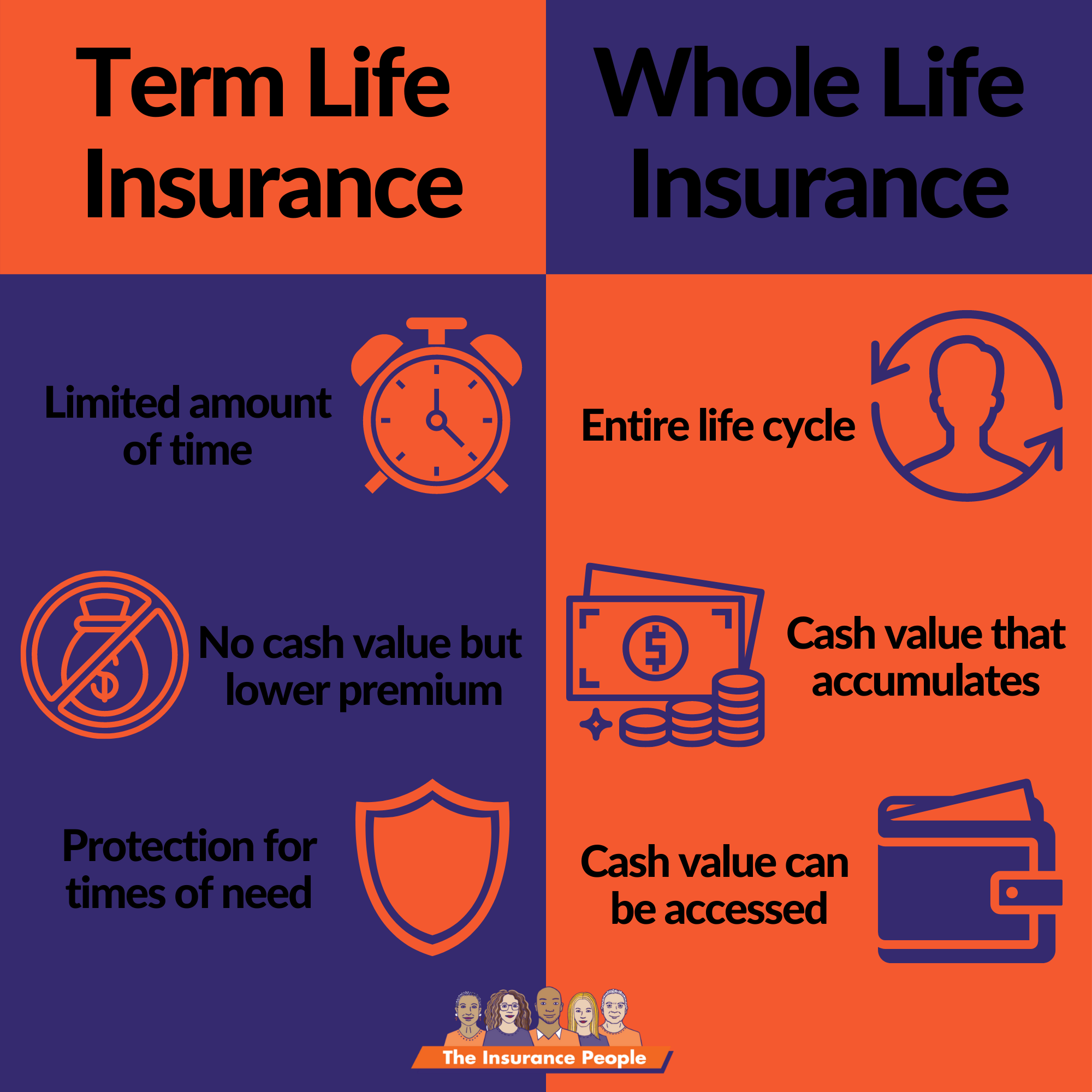

Life insurance firms supply various kinds of term plans and traditional life policies as well as "passion delicate"items which have ended up being a lot more prevalent given that the 1980's. An economatic whole life policy supplies for a standard quantity of getting involved entire life insurance policy with an extra supplemental protection given through the use of dividends. There are 4 standard passion delicate entire life policies: The global life policy is really more than interest sensitive as it is created to show the insurance company's existing death and expenditure as well as rate of interest incomes rather than historical prices.

You may be asked to make added premium repayments where protection could end because the interest price dropped. The guaranteed rate supplied for in the plan is a lot lower (e.g., 4%).

Term Life Insurance To Age 100

You need to obtain a certificate of insurance coverage defining the stipulations of the team policy and any insurance coverage cost - what does 15 year term life insurance mean. Typically the optimum quantity of coverage is $220,000 for a home loan and $55,000 for all various other financial debts. Credit score life insurance policy need not be bought from the organization providing the funding

If life insurance policy is needed by a creditor as a condition for making a loan, you might have the ability to appoint an existing life insurance policy, if you have one. You may want to acquire team credit history life insurance in spite of its higher cost because of its ease and its schedule, typically without detailed proof of insurability. wisconsin term life insurance.

However, home collections are not made and costs are sent by mail by you to the agent or to the company. There are specific factors that tend to raise the expenses of debit insurance coverage even more than routine life insurance policy strategies: Specific expenditures are the same no issue what the dimension of the plan, so that smaller sized plans released as debit insurance will have higher costs per $1,000 of insurance policy than larger size normal insurance policy policies

Considering that very early lapses are costly to a firm, the costs need to be passed on to all debit insurance policy holders. Given that debit insurance policy is designed to consist of home collections, greater compensations and fees are paid on debit insurance policy than on normal insurance policy. In most cases these greater costs are passed on to the insurance holder.

Where a company has different costs for debit and regular insurance policy it might be possible for you to buy a larger quantity of normal insurance than debit at no additional cost - a return of premium life insurance policy is written as what type of term coverage. If you are thinking of debit insurance, you ought to certainly explore routine life insurance policy as a cost-saving choice.

Voluntary Term Life Insurance

This plan is developed for those that can not at first pay for the regular whole life premium but who want the greater costs insurance coverage and feel they will at some point be able to pay the greater costs (renewable term life insurance policy can be renewed). The family policy is a combination strategy that supplies insurance policy protection under one agreement to all participants of your instant family hubby, better half and children

Joint Life and Survivor Insurance policy gives protection for two or more persons with the survivor benefit payable at the death of the last of the insureds. Premiums are considerably lower under joint life and survivor insurance policy than for plans that insure just one person, given that the chance of needing to pay a fatality insurance claim is lower.

Premiums are significantly greater than for policies that insure a single person, considering that the probability of needing to pay a death claim is higher (what is optional term life insurance). Endowment insurance policy gives for the settlement of the face total up to your beneficiary if death happens within a particular amount of time such as twenty years, or, if at the end of the specific duration you are still alive, for the payment of the face amount to you

Latest Posts

Term Life Insurance Expires

Extending Term Life Insurance

Final Expense Life Insurance Rates